I want to start off by thanking all of you for reading my blog and for contributing to my campaign to raise funds for The Nudge Foundation. I have reached 20% of my target in six days and I am sure that I will reach my target soon.

Today I am going to talk about how I discovered what my disposition effect was costing me. Just to remind you: Disposition effect is holding on your losing positions and selling winners early.

In 2011-12 when I was evaluating my portfolio I did an exercise. I examined the list of stocks and I found a pattern. I had belief that a long term investor doesnt sell easily and consequently held on to positions for way too long.

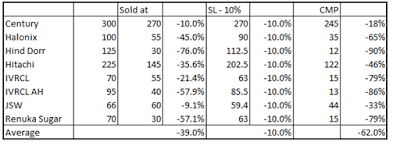

Below is a list of stocks which were losers. I have assumed an equal position size. And the loss I booked when I sold and the loss I would have suffered if I had sold them when they went down 10%. And in the third column, CMP, is the market price when I carried out the exercise in 2013 ( am not sure of the exact month).

Today I am going to talk about how I discovered what my disposition effect was costing me. Just to remind you: Disposition effect is holding on your losing positions and selling winners early.

In 2011-12 when I was evaluating my portfolio I did an exercise. I examined the list of stocks and I found a pattern. I had belief that a long term investor doesnt sell easily and consequently held on to positions for way too long.

Below is a list of stocks which were losers. I have assumed an equal position size. And the loss I booked when I sold and the loss I would have suffered if I had sold them when they went down 10%. And in the third column, CMP, is the market price when I carried out the exercise in 2013 ( am not sure of the exact month).

I sold the stocks at 39% loss but if I had held on to them I would be sitting on a 62% loss.

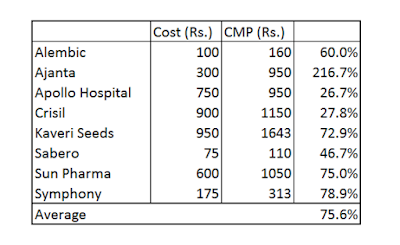

Given below is a list of winners. These stocks did not dip by more than 10% from my time of purchase. This table shows that profits take care of themselves. The average gain on winner portfolio was 75.6%.

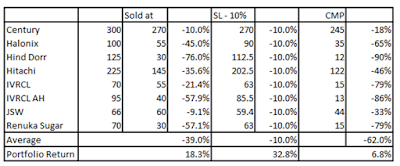

And then I put the the winner and loser portfolio together see how much the portfolio makes on average in three scenarios. The first scenario is the actual scenario, the second scenario is the one in which I cut losers if they fall 10% and in the third scenario if I continued to hold on to them.

In the scenario where I sold stocks where I did, I ended up with a respectable 18.3%. But if I had continued to hold on to the stocks for another 6-12 months my returns from the portfolio would have fallen to 6.8% : a return below FD returns. But the big stunner was the portfolio return of 32.8% if I had sold my loser stocks when they fell by 10%.

And now whenever I try to hold on to losers for too long this table comes to my mind. The 10% Stop Loss is not sacrosanct. Some small/mid caps may fall even further before moving up and so a differential Stop Loss number has to be used of large, mid and small caps. This blog was more to illustrate how important it is to recognize that if a stock you have bought has gone then you have got one of two things wrong : either you picked the wrong stock or you got the entry time wrong. Either ways you were wrong. Good and strong stocks usually take off immediately.

I would encourage and urge all of you to do this exercise for your own portfolio. It may turn out be an eye opening moment and change your investment portfolio returns.

All the best. Please support the Nudge Foundation. They are doing a wonderful job. You can donate here. No amount is too small or big. Your participation will give the foundation and me a lot of joy and encouragement.

Regards

Anish

Important Disclaimer: Please do not treat anything on my blog as investment advice. I do not provide any recommendations of any stocks or securities. Any stock mentioned may be merely by way of an example.

No comments:

Post a Comment