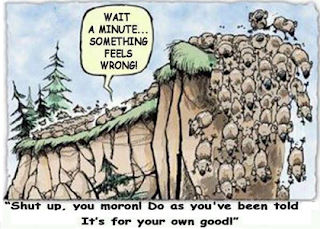

Herding Bias: Also known as the “bandwagon effect,” herding

is the tendency for individuals to mimic the actions of a larger group.

Shepherds, Teachers and Pied Pipers in the stockmarket use

this bias to great effect. I used to observe my kid's teachers. They ensure that and the

first 3-4 kids were walking properly in line and then rest of the class would line

up. Shepherds identify the leader in the herd and use them to keep the rest of

flock in control. There are many in the stock market who use this a lot. Financial news channels who get "ëxperts" to predict the next 50-100 point "big move". I only have one question for the viewers: If the experts knew, why are they still coming on TV and telling you all this. After all the stock market is a zero sum game. But humans are gullible and want to be led like sheep.

Adult humans are bit more complex but as a group they behave

similarly. There is a modern word for the bandwagon effect - FOMO - Fear of

Missing Out. The younger generation uses this word a lot. But it has been

around for centuries. Everyone wants to be cool, have the latest "in

things" etc.

And hence diamonds are sold not because they convey your

love for your beloved effectively, but because everyone does it. Everyone wants

the new iphone, the new "new" thing.

As I explained in the blog on how bubbles are formed. When a

sound rational premise is taken too far, price action takes over. We dont pause

to think if the original premise still holds true. If it has been true for so

long it must be still true. I repeat a paragraph from that blog because it is a

recent and very prevalent example.

In his testimony to the Financial Crisis Investigation

Committee, Buffett is said that the housing market demand was driven by a sound

reason to buy a home because over a period or time it costs more to buy a home

and if you are going to buy a home to reside in it then it better to buy early

than later. However, as time passed genuine demand for housing began to taper

off, but the supply of financing continued to be strong. And this caused

housing prices to go up and at some time buyers were buying homes not because

they wanted to stay in those homes but because prices were increasing at a

rapid pace and cheap financing was available. And a sound investment premise

became a bubble. The crossover point is known to none. And that's what makes it

a market.

A trader wakes up in Tokyo and looks at what US has done overnight. Indian trader wakes up to see what Singapore, Hkg and Tokyo are doing. Europe ambles in about 5 hrs later and checks what Asia is doing. And US wakes up again to see what Europe is doing and where Asia has closed. And then the merry go round starts again.

Investors and traders are lemmings. No one wants to be left behind even if one is jumping off the cliff.

But thats how it rolls.

About 100-150 people are reading this blog everyday. Thank you very much for it. And only 5 have contributed so far. So please use your online payment method and make a contribution.

http://thenudge.ketto.org/anishpteli

More tomorrow.

Regards

Anish

No comments:

Post a Comment